Here’s a reason why you should use your Paid-Up Additions to “overfund” your whole life insurance according to Guardian. The whole idea of whole life insurance as an investment is to get into the black ASAP — with a PUA, you’re able to see your investment pay off quickly. Of course, the catch is you’ll have to pay to play and be patient.

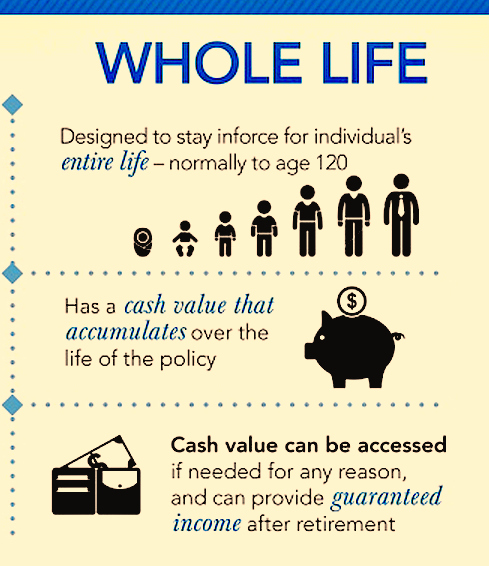

Whole life insurance provides stability and security, with guaranteed financial protection against untimely death plus an efficient way to pass on wealth to your heirs. It is a long-term asset, developing cash values which can grow to a significant amount over time, and can be accessed through withdrawals and loans.

The Asset That’s Not Affected by Stock Market Fluctuations

There is virtually no other financial asset like whole life insurance. Compare some

of its features with other financial instruments the benefits are exceptional

- Guaranteed death benefit, typically income tax-free to beneficiaries.

- Guaranteed cash value is not correlated to the stock market.

- Access to cash available through withdrawals and loans. Policy loans may be

income tax-free as long as the policy is in force. - Policy can be transferred or pledged as collateral for a loan.

- In the long run, the cash values provide stable returns over time.

- Self-completing in the case of disability with a Waiver of Premium Rider.

Overfunding: Leveraging Your Assets When More is More

Over and above the value provided by your whole life policy, there is also an optional feature that not everyone has, but it provides even greater benefits as a portfolio asset. The Paid-Up Additions Rider (PUA) allows the purchase of additional paid-up insurance, with flexible payment options and at favorable rates to enhance the policy’s value. Extra dollars can work harder here (meaning the more money you invest, the more dividends you’ll earn), boosting values at an accelerated pace!

Money On the Sidelines

Where are you putting your extra cash these days? Suppose you earned a $25,000 bonus. What can you do with a one-time cash windfall? Let’s see what happens to a policy’s values and returns if the policyholder makes a one-time PUA payment of S25,000. This hypothetical example shows results for a 40-year-old Best Class, with a policy of $1 million in face amount. Please note that a contribution of $100 is required each year the policy is in force to maintain the PUA rider option, but that amount is not included in the following chart in order to highlight the effect of the $25,000 one- time contribution in policy year 3.

The PUA payment is made at the beginning of the policy year. Please note that the required annual contributions of $100 are not included in policy years l and 2 in this example

Cash value results only from the $25,000 extra payment, and is shown at the end of the policy year. Cash values include both guaranteed cash values and dividends, Values are based on Guardian’s 2015 dividend scale and are subject to change. Dividends are not guaranteed. They are declared annually by Guardian’s Board of Directors.

This rate is the pre-tax earned rate that is needed to replicate the IRR, assuming a 30% tax bracket. The policyholder used the $25,000 bonus as a PUA contribution in policy year 3

n ideal strategy for cash received from a bonus or from the sale of an asset. When considering alternatives for money on the sidelines, be sure to include life insurance. How do these rates look to you?

Flexible Features Built for Change

Since life insurance is a long-term asset designed to fit your financial profile during your lifetime, the Paid-Up Additions Rider on a whole life policy was created to dovetail with the policy to provide more control. The PUA allows you to:

- Schedule an amount that you wish to pay with your policy premium each year.

- Make unscheduled payments, within policy limits, at any time, assuming that the rider is selected and funded at issue.

- Alter payment amounts from year to year, which will affect the cash value growth.

- Earn dividends on the additional paid-up insurance purchased. The timing of the payment relative to the policy anniversary will affect policy values.

Moreover, as values build, the policy becomes a source of ready, liquid cash available. And, just as policy loans are typically available income tax-free, withdrawals from PUA are income tax-free up to the policy basis. Plus, the PUA is not a contractual obligation just an annual contribution of $100 keeps this option open. In the event of disability, a Waiver of Specified Amount rider purchased

when the policy was issued would cover specified PUA payments in addition to the policy’s premium.

Why Guardian?

The company you choose is as important as the policy you purchase. Guardian is a mutual life insurance company, operating for the benefit of participating life insurance policyowners who share in the company’s results, in part, through the payment of annual dividends.

Unlike stock-based companies, there are no outside shareholders, so the company is managed to maximize the long-term interests of its clients. While dividends are not guaranteed, Guardian has paid dividends to participating policyholders every year since 1868-through good and

bad economic times. In November 2014, Guardian’s Board of Directors approved a dividend payout of $784 million to its individual life policyholders in 2015.

The chart below illustrates Guardian’s steady dividend history from 2010-2014.

Here’s the top dividend-paying whole life insurance companies (comparison by dividend rate)

What the Rating Agencies Say

Guardian has received excellent ratings from the four major rating agencies, and our ratings for financial strength and stability have been reaffirmed since 2009, during a time of exceptional economic uncertainty.